Background

The Arab Gulf Programme for Development (AGFUND) and UNITAR launched the Global Learning Platform on Financial Inclusion in October 2019. The initiative aims to enhance capacities on financial management and financial inclusion. It is oriented to finance practitioners, particularly in micro-credit financial institutions and in government entities fostering financial inclusion of women and young entrepreneurs, as well as officers in governments, NGOs and other civil society organizations. Since its launch, AGFUND and UNITAR have delivered eight online courses and 2 e-workshops on the platform, all free of charge, targeting participants from least developed countries, landlocked developing countries and small island development states; especially from Sub Saharan Africa, the Middle East and North Africa. To increase the likelihood of reaching the intended beneficiaries, a selection process was carried out for each learning event and the platform was made available in desktop version and through a mobile app.

This Impact Story showcases participant’s application of knowledge and skills after at least five months of completing the courses, and discusses opportunities and challenges associated to application of knowledge ad skills. The eight online courses included in this Impact Story are:

- Fundamentals of Microfinance (for the MENA and SSA region);

- Leadership Skills for Finance Managers (for the MENA and SSA region);

- Fundamentals of Anti-money Laundering: International Standards and Compliance Issues;

- Fundamentals of the Capital Market Development and Regulation;

- Negotiation of Financial Transactions; and

- Fundamentals of the Financial System.

The courses had a total enrolment of 1,101 successful participants, with 723 unique beneficiaries (22 per cent of beneficiaries enroled in more than one course). We conducted a follow-up survey with participants, receiving 201 responses (28 per cent response rate), and five in-depth interviews to better understand participants’ changes of behaviour at work after the completing the course. The course participants come from 108 countries (Figure 1), mostly from Kenya (183), followed by Nigeria (83), India (38), Zambia (21), Ghana (18) and Sierra Leone (18). Leadership skills for finance managers, fundamentals of microfinance and fundamentals of anti-money laundering, were the most well attended, as shown in the figures below

Application of knowledge and skills from online courses

Most of the survey respondents who took part in the online courses were working in the private sector (29 per cent), government agencies and ministries (26 per cent), academia (15 per cent), and NGOs (9 per cent), and working mainly in areas related to (micro)finance or had an academic or personal interest in the topic. At least 49 per cent were working in institutions or departments addressing financial issues, 7 per cent were (co-)owners of a start-up company and 3 per cent were students. Moreover, most of the respondents indicated being involved in financial issues in their work. Specifically, from those who participated in the course “Fundamentals of microfinance” 85 per cent of respondents confirmed their work was mostly or fully related to sustainable microfinance and financial inclusion. Similarly, 86 per cent of the participants from the course “Negotiation of financial transactions” were involved in processes of negotiating financial transactions, procurement or funds acquisition.

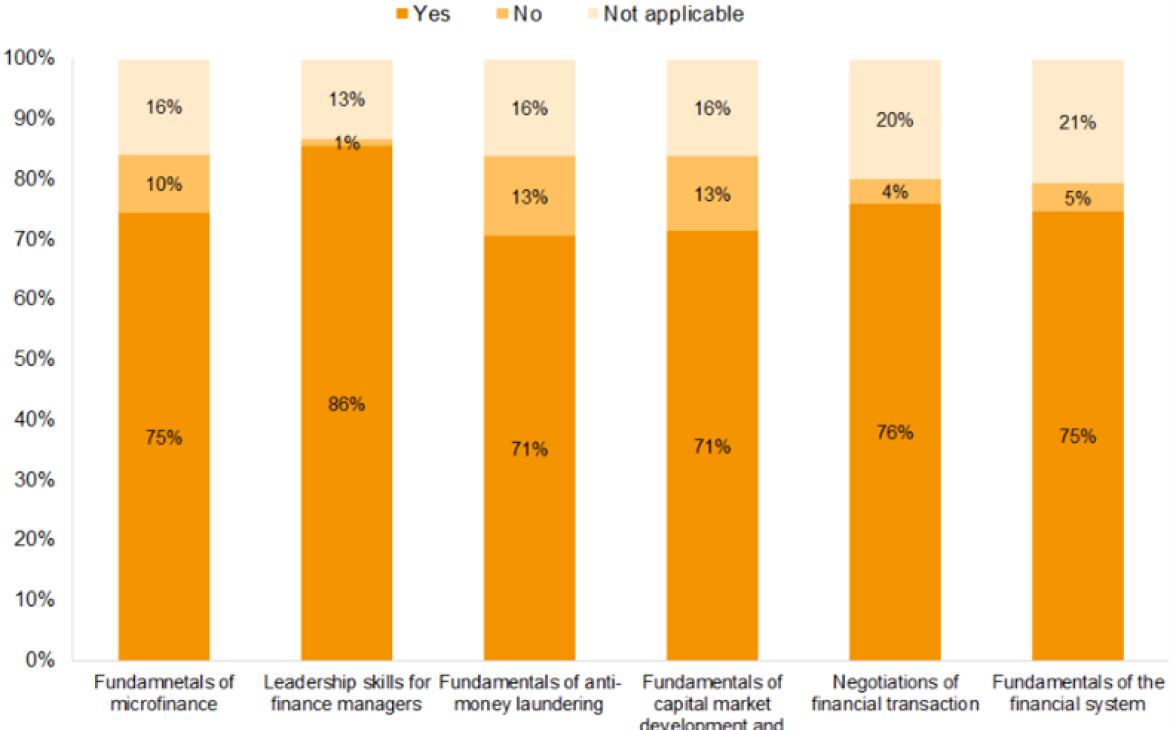

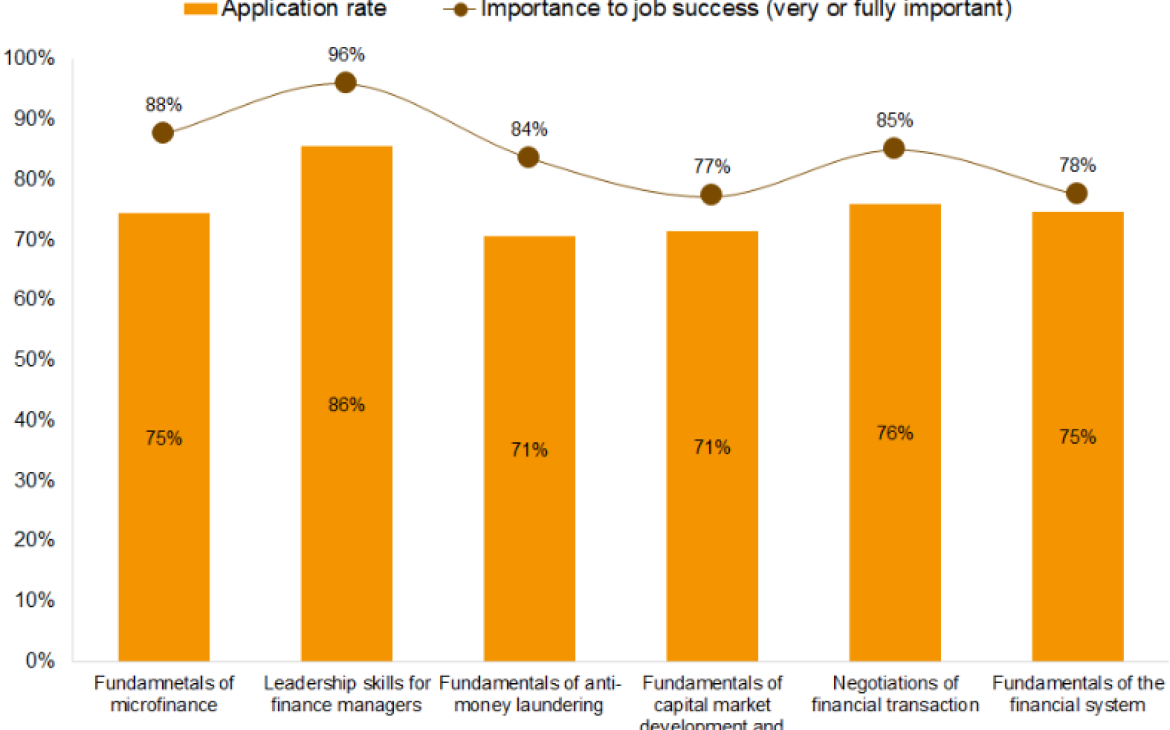

The online courses had a good rate of application of knowledge and skills to the workplace (all above 70 per cent). The courses with the highest application rates were leadership skills for finance managers, negotiation of financial transactions and fundamentals of the financial system. Figure 2 below shows the application rate for each course. The course “Leadership skills for finance managers”, besides showing the highest rate of application, was the most pertinent to the participant’s needs. For this course, 98 per cent of the respondents indicated the course addressed their needs as leaders, while the remaining two per cent were not necessarily in a leadership position (2 per cent selected not applicable). Also, as indicated in Figure 3, 96 per cent of the participants in the course considered the application of knowledge and skills to be very, or fully important for their job success. It is worth mentioning that, generally, for the courses with the highest application rates, the application of knowledge was considered of great importance for the respondents’ job success.

In Figure 2, the proportion of respondents selecting “Not applicable” were mostly students, people not working (unemployed or on leave), or participants whose work was not directly related to the topics but took the courses to gain more knowledge (e.g., media writer, human resources officer, health administrators, etc.).

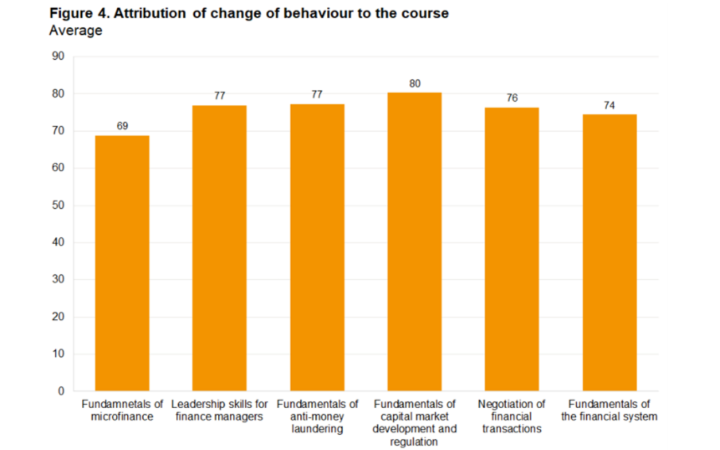

The interviews conducted for this Impact Story (presented in the next section) demonstrate that survey respondents had a strong academic and/or professional background in financial issues. Despite this, the attribution of changes to the online courses was high (at least 69 per cent, on average). Fundamentals of capital market development and regulation, fundamentals of anti-money laundering and leadership skills for finance managers had the highest rates of application, as shown in Figure 4. The survey responses also confirm that although some of the respondents had previous knowledge and experience in the topics the courses brought new technical elements to them. For example, from the respondents who participated in the course “Fundamentals of anti-money laundering” 74 per cent were somewhat, slightly or not at all familiar with new/modern frameworks and regulations for anti-money laundering, and only 26 per cent were very or extremely familiar with them.

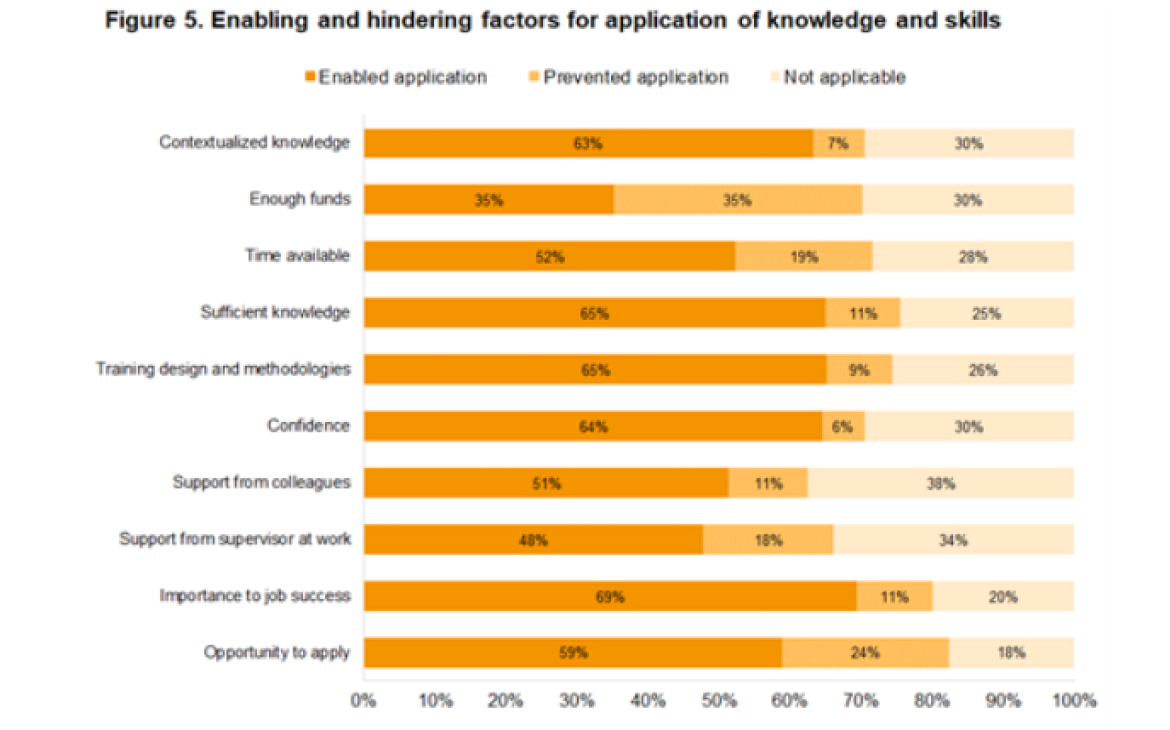

In line with the relationship between application of knowledge and importance to job success mentioned above, the latter was the most important factor to allow application of knowledge and skills, followed by having sufficient knowledge to apply and the training design and methodologies. Regarding course methodologies, the survey respondents and interviewees appreciated the quality and visual presentation of the materials and suggested including more live videos and making the lectures more interactive between tutors and participants to improve even more the acquisition of knowledge. Also, many were interested in follow-up courses to continue expanding their knowledge.

On the other hand, the factors that challenged most the application of knowledge and skills were not having enough funds available, lack of opportunity to apply the knowledge and lack of time. Figure 4 shows enabling and hindering factors for the application of knowledge and skills from the online courses.

IMPACT STORY - Lupia Sairin

- Founder of Lyseis and mechanical and manufacturing engineering student

- Improving financial inclusion of women in Kenya

Nairobi, Kenya. Lupia is a mechanical and manufacturing engineering undergraduate student in the University of Nairobi, Kenya. He is 21 years old and works in the area of microfinance. Lupia is a Certified Public Accountant (CPA), which is where his interest in financial matters comes from. The university shared the invitation for the AGFUND-UNITAR courses with its students and, given his interest in the field, Lupia decided to apply. Besides, Lupia was interested in taking training with the UN, which also motivated his application. He, and two of his classmates, were successful in their applications. Lupia enrolled in two courses: Fundamentals of Microfinance and Negotiation of Financial Transactions and used EdApp on his mobile phone to follow them. The courses not only equipped Lupia with new knowledge about financial inclusion but inspired him to create his own initiative to address financial inclusion in his country.

Lupia co-founded a microfinance institution that helps women of low-income background to integrate into the financial system. The idea came from the first course Lupia attended, “Fundamentals of Microfinance”, which emphasized the challenges and provided positive approaches to improve access to financial services. The initiative follows a collective scheme (idea that also came from the course) where women organize themselves in groups to serve as guarantors of each other when borrowing money. So far, the initiative has 10 women, called “Chamas” in Swahili, from a local area with small businesses. Each of them contributes 500 Kenyan-shillings per month (approximately US$5) to a saving fund that is available for them when needed. Lupia’s company has already led to some positive results. For example, one of the women has diversified from selling tomatoes only to including fruit in her business, and another was able to send her child to a better school, both as a result of their engagement in the initiative. Lupia acknowledges that they are still learning to manage the group but have found the information from the course essential to the functioning of their enterprise.

Lupia wants to expand the initiative in the future to help more women to access to credit by applying to one of the funds offered by the government to support new businesses owned by young people. For this process, Lupia has incorporated knowledge from the Negotiation of Financial Transactions course. He used the knowledge to draft the business proposal submitted to the board. The proposal incorporated a debt-for-control strategy of the company and details on how they plan to invest the money as well as generate profits, both incorporating elements form the online course.

Besides the knowledge from the AGFUND-UNITAR courses, Lupia has used his knowledge as a CPA to improve his initiative. Also, during his undergraduate studies Lupia has learned communication skills he considers to have helped him to achieve his goals. Nevertheless, the influence from the online courses on his performance in the microfinance initiative is not minor. Lupia recognizes that the courses were his main motivation to start the company.

Lupia and his colleagues have plans to expand their microfinance initiative as they continue gaining more experience. In his words, the initiative can grow from 10 to 100 to 1,000 women or other people in need. Overall, Lupia is very satisfied with the knowledge obtained during the online courses, however, he would have loved to have more interaction with other participants from the course beyond their exchange in the class forums to share their professional experiences. He considers that this additional knowledge would probably be useful to know some good practices and barriers experienced by others doing similar things.

IMPACT STORY - Hawa Momo-Seh

- Finance assistant at International Development Law Organization

- Better leadership and negotiation skills to improve job performance

Liberia. Hawa has a strong background in financial matters. She holds a bachelor’s degree in economics and is currently working as a finance assistant at the International Development Law Organization (IDLO), an international organization. She supports the activities related to payments to vendors, procurement, approval processes, promotion of internal financial policies, elaboration of financial reports, among others. Hawa learned about the courses on financial inclusion through a friend. The courses focus on an area in which she has been interested in and wanted to expand her knowledge and leadership/supervision and negotiation skills as she considers financial inclusion is of great relevance in the context of Liberia. Hawa first enrolled in the course “Leadership skills for Finance Managers” and then in “Negotiation of Financial Transactions”. After completing the courses, she considers she has improved some of her day-to-day job tasks by enhancing technical and soft skills.

Hawa enrolled in the first course planning for the future, as she expects to grow professionally and become a finance manager. However, she has started to do things differently in her current position. Hawa said that before the course her work style was very individualistic but now she has been more open to work collectively. She also was less likely to ask for help and incorporate a team perspective into her work, but now she even enjoys working in a team and has realized how much one can learn from others while working together. For example, she recently assisted one of her colleagues who was struggling with a task instead of taking the assignment herself, that is how she would have proceeded in the past.

The hard skills from the second course have also been of use to Hawa. Although she is not directly involved in financial transactions at the macro level, she has incorporated negotiation techniques when doing her procurement activities. Hawa considers that her negotiation skills have improved after taking the course and now she does not accept higher procurement quotations without verifying that the product is actually better than the others and does not accept a lower quality product than what was promised. She considers this benefits the organization as they can obtain better products and value for money according to their needs and budget.

Hawa feels very confident to continue applying the knowledge from the courses. She believes that once you have the knowledge you can make better decisions and support others. Besides the content from the course materials, Hawa could learn from other participants in the region while they interacted in the forums and when peer reviewing their assignments. She considers these to be valuable aspects of the course. Hawa would like to see more young people engaged in learning activities related to financial inclusion, considering its importance in the region.

IMPACT STORY - Kofi Akodwaa-Boadi

- Project manager and researcher at Kwame Nkrumah University of Science and Technology, and member of the Board of Directors at VisionFund

- Incorporating knowledge on financial inclusion for better decision-making

Kumasi, Ghana. Kofi, just like Kofi Annan was born on a Friday and given the name “Kofi” following a tradition of his region. He holds a bachelor’s degree in chemistry and a specialization in water, sanitation and hygiene (WASH), on which he has focused his work. He is currently working at Kwame Nkrumah University of Science and Technology researching and managing WASH projects. Thanks to his experience in the WASH sector, Kofi had the opportunity to join the Board of Directors at VisionFund, a microfinance institution that offers WASH loans as part of its services. He has been a member of the board for two years now. In his first board meeting, Kofi was expecting the discussion to concentrate on technical aspects related to WASH but he was surprised that the main focus was on financial issues. As he was less experienced in this area, he decided to improve his knowledge on financial inclusion by enrolling on the “Fundamentals of Microfinance” course. With the new knowledge on microfinance, Kofi now feels more confident to give advice to the institution and has incorporated the knowledge into some of his personal projects.

One of the course topics that has helped him in his role as a board member is managing and understanding growth in the microfinance sector while having good risk management and being aware of the regulations for the sector. These topics were eyeopening for him and now he pays more attention to these issues. For example, on one occasion when the board members were about to take a decision, he first checked whether this was allowed by the regulation in Ghana and realized that it was not. In this regard, Kofi considers that after having completed the course he has been able to serve better on the board. Also, he feels more confident to ask questions, debate, and push management during the presentation of key performance indicators related to MFI functioning. Kofi considers that without the course he would not have understood some of the indicators as he does now. After the course, he also understands better and advises on issues related to fraud and its relationship with IT infrastructure.

Besides his work in the MFI and the University, Kofi manages a start-up that aims to create awareness and provide digital technology to manage plastic waste in the country in upcycling and recycling processes. Kofi has also incorporated some of the knowledge from the course in this initiative, though to a lesser extent. The course has helped him to improve his grant proposals by providing a stronger plan about how to scale-up the project, the strategies to ensure profit, and especially, the governance structure of the company.

Kofi confirms that the training materials and methodologies supported his learning process, particularly the very good (according to him a score of “110 out of 100”) design and clarity of the presentations and the peer review exercises that allowed him to learn from peers in other African countries. Besides, Kofi likes to search, read and learn things related to microfinance in his free time, which for sure helps him to improve his knowledge. However, he attributes most of the changes that he has experienced to the course and has a good appreciation of it.

IMPACT STORY - Stacey Weever

- Attorney & Co-founder of Consultancy Experts Inc.

- Anti-money laundering skills to advise Guyana’s oil, gas and mining sectors

Georgetown, Guyana. Stacey is an attorney-at-law with vast experience in civil, criminal, corporate and environmental law. She also holds a master’s degree in oil and gas law and another in mining law, both growth sectors and economic motors of Guyana. Stacey is also a Certified Anti-Money Laundering Specialist and a Chevening Alumni. Last year, she co-founded a consultancy firm that provides advisory consultancy and project management services relating to oil and gas investment projects, mining projects, procurement ventures, civil-engineering works, stakeholder consultations and anti-money laundering compliance. Before founding the firm, Stacey worked at the national agencies which regulate mining and gold trade activities in the country. Given the strong relationship of trade and financial issues she decided to expand her knowledge on financial matters and researched certified online courses that did not require a specialization in finance but that could provide quality and new knowledge. The course “Negotiation of Financial Transactions” was the one that met her requirements. Stacey describes the course as challenging, in a way that participants needed to read and understand the materials in order to pass the tests and move to the next modules. She feels very proud of having completed the course and, further, has incorporated some of the knowledge from the course into her work in the consultancy firm. Besides, she believes the course certificate has improved her resume.

Stacey has kept her notes from the course and reviews them constantly when preparing for meetings and presentations. She revises her notes and includes some elements from the course as conversation starters in her meetings and training exercises. After taking the course, Stacey confidently negotiates financial terms as she recognizes that she is more knowledgeable and can confidently negotiate and lead discussions involving new and ongoing oil, gas and mining projects. Stacey now drafts her financial proposals for new and ongoing projects with more confidence, her most recent financial proposal was completed after reviewing her course notes and utilising the techniques she learned during the course. The course taught her how to present financial data by anticipating what is expected during the initial stages of the negotiation cycle. Before completing the course, she would have assigned this task to a qualified Accountant but now she is more involved in these processes at the firm.

At Consultancy Experts Inc. Stacey also provides risk assessment services and trainings on anti-money laundering (AML-CFT) compliance for specific sectors. In this regard, Stacey has directly incorporated negotiation techniques from the course into her trainings. As an example, she advises her clients to incorporate specific questions learned from the course to determine whether they are a legitimate client in the gold or mining trade. An unexpected result from the course is an improvement in her training delivery skills. Besides incorporating technical knowledge, Stacey has found the course useful for structuring her own training, using it as a comparison to design her own training sessions.

Stacey liked the course very much and highlights the combination of theory, case studies and participant forums as a positive factor that facilitated the learning process. Before completing the course Stacey had planned establish her own company. Today, she is convinced that the course was a confidence booster while she was starting her new position.

IMPACT STORY - Sidiki Koula

- Independent Financial Consultant

- Leaving no one behind in accessing financial services

Guinea. Sidiki is an independent financial consultant for small and medium-sized enterprises (SMEs). He has a bachelor’s degree in management and a master’s degree in management and financial analysis. Sidiki’s work focuses on providing financial advice and training to microentrepreneurs in the informal sector, especially women in rural and peri-urban areas and persons with reduced mobility. Most of Sidiki’s final clients have very little, or no formal schooling which, added to being in the informal sector, makes access to financial services more difficult. Part of Sidiki’s services is adapting financial information to make it more accessible to people with low literacy, for example, by simplifying financial documents and business plans preparations. With the desire to improve his work and help more people in disadvantageous situations, Sidiki enrolled in the course of fundamentals of microfinance at first, but he later had the opportunity to complete all six courses offered by the platform. Sidiki has found the information from the courses very useful, particularly from those on fundamentals of microfinance, fundamentals of the financial system and fundamentals of anti-money laundering. Moreover, he has been able to apply knowledge and skills from the courses to his work as an adviser and trainer and considers that the courses allowed him to provide financial assistance with more confidence.

Sidiki led an accelerated financial literacy training programme for thirty women working in different industries in the informal sector, most of them constituted in rotational credit and saving clubs. Similarly to Lupia, Sidiki has also focussed his efforts on empowering women. The information on challenges to accessing the financial market and the operation of credit groups from the course helped him to provide better training. In Guinea, women may face additional challenges to accessing financial services as gender norms might make it more challenging for them to take financial decisions alone, which is usually decided by the partner. However, with the training some of them were able to access credit from microfinance institutions or from governmental funds. Sidiki has also provided training for an Association for disabled People (Association pour personnes handicapées) in the forest region of Guinea. Besides making the information more accessible, he used technology to address the problem of mobility. Specifically, the organization is promoting the use of digital financial services by phone so people can manage their accounts and other financial issues, without having to travel to the branches and hence overcome some of their physical barriers.

Besides the improvement in his knowledge, Sidiki believes that the emergence of digital technologies (e.g., making transactions using the phone) has helped him and his clients to see positive results. In the case of women, for example, who sometimes have limited time to go to financial institutions (or cannot decide on their own), they can check their accounts using their phones. He thinks this is especially useful in rural areas, which are further away from the financial branches.

Sidiki is determined to continue supporting financial inclusion for vulnerable people in his country. Overall, he is satisfied with the information provided in the online courses, particularly the case studies approach that helped him better understand the applicability of theoretical knowledge.

Conclusion

The AGFUND-UNITAR online courses attracted not only professionals directly involved in financial or microfinance issues but also students and professionals from other areas with interest in the same topics. The courses had a good application rate producing changes in the participants' hard and soft skills, as illustrated by the interviewees. The application ranges from changing behaviours to a more collaborative style, improving confidence and engagement in the activities at work, transferring knowledge and creating new initiatives directly linked to (micro)finance. The online courses also served to create awareness about the importance of financial services provision to vulnerable groups. In particular, examples of application of knowledge from the “Fundamentals of Microfinance” course emphasized the work with disadvantaged groups, such as rural women or disabled people.

As expected given the participants’ profiles, the lack of opportunity to apply knowledge and skills was one of the challenges for application. In contrast, being involved in an area that directly requires the application of knowledge from the courses was an enabling factor. The importance of application for participants’ job success was the main reason. Although some participants had less direct application or transfer of knowledge and skills from the courses, they did express having a better understanding of the topics covered by the courses and felt confident to incorporate this knowledge when required in future responsibilities.

The training material and methodologies were recognized as a strong feature of the courses, specifically the peer review process and participation in forums. However, more interaction between participants and with tutors, incorporation of live videos into the lectures, and extension of courses length, or follow-up courses of the topics introduced, were proposed to improve the courses even more, as well as its application in the workplace.